How to Automate Your Backtesting Workflow with Pine Script AI

Backtesting is essential to validate any trading strategy—but it’s often tedious and time-consuming. Manually writing Pine Script to simulate trades, manage risk, and visualize performance on TradingView can take hours.

That’s where Pine Script AI changes the game.

With just a simple prompt, you can generate fully functional Pine Script code ready for backtesting—complete with inputs, conditions, and strategy performance metrics.

Why Automate Backtesting?

Traditional backtesting involves:

-

Writing entry/exit logic manually

-

Handling strategy.entry() and strategy.close()

-

Adding risk management rules

-

Testing different parameter combinations

Each of these steps adds complexity and room for human error.

With Pine Script AI, this entire workflow can be automated by simply describing your strategy in plain language.

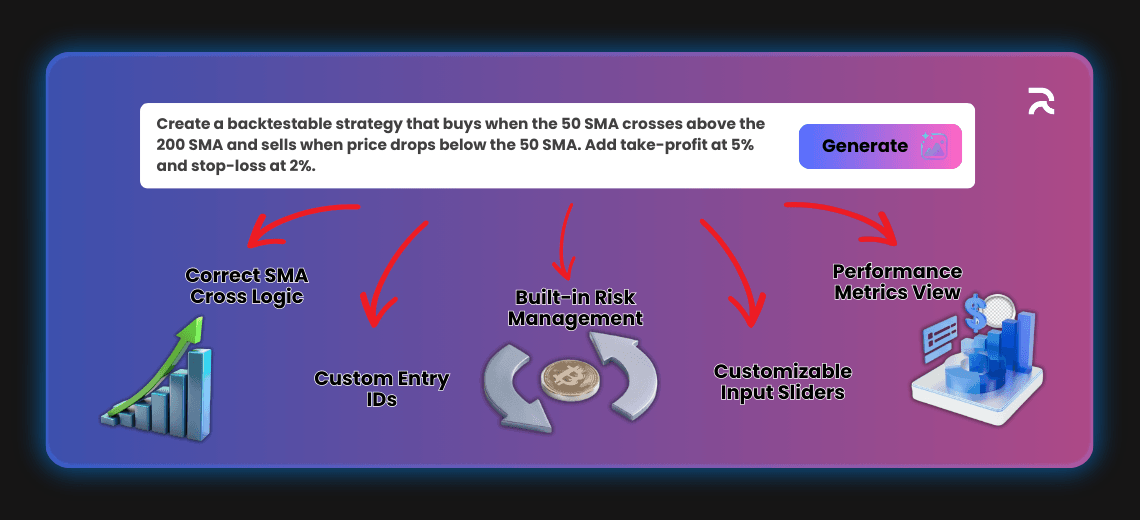

Example: From Prompt to Backtest in Seconds

Let’s walk through a real example.

Prompt:

“Create a backtestable strategy that buys when the 50 SMA crosses above the 200 SMA and sells when price drops below the 50 SMA. Add take-profit at 5% and stop-loss at 2%.”

What You Get:

-

SMA cross logic correctly scripted

-

strategy.entry() with custom IDs

-

Built-in risk management using strategy.exit()

-

Input sliders for customization

-

Performance data viewable on TradingView

You can immediately run this script on any symbol and timeframe to view win rate, profit factor, drawdowns, and more.

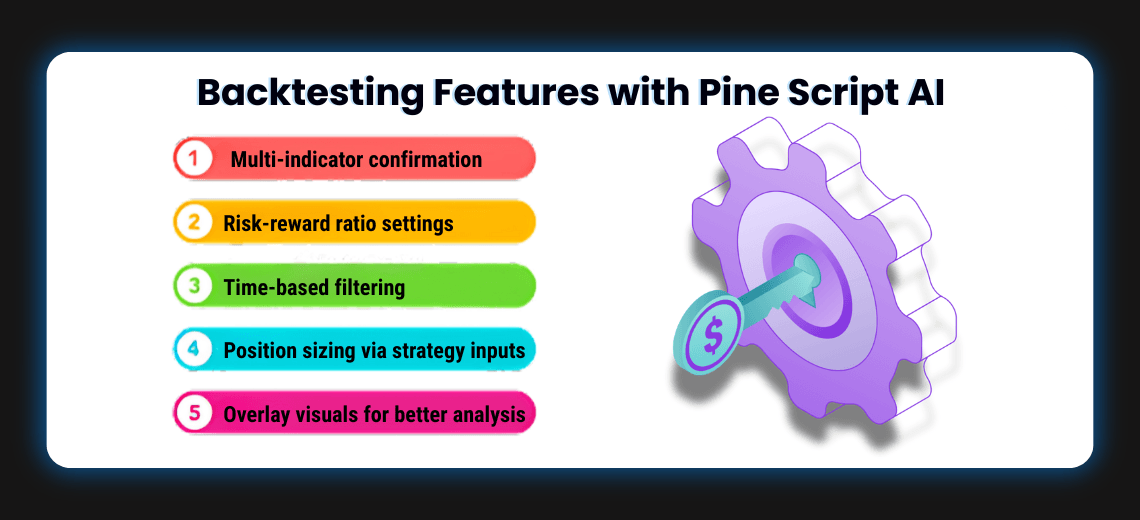

Advanced Backtesting Features Pine Script AI Can Handle

Here’s what you can generate using prompt-based logic:

✅ Multi-indicator confirmation

✅ Risk-reward ratio settings

✅ Time-based filtering (like session windows)

✅ Position sizing via strategy inputs

✅ Overlay visuals for better analysis

All without needing to touch a single line of code manually.

Benefits for Quantitative Traders

-

Rapid prototyping: Test 5–10 strategies a day instead of 1 or 2.

-

Fewer bugs: The AI generates clean and syntactically correct Pine Script.

-

Focus on logic, not syntax: Traders can focus on edge discovery, not debugging.

This unlocks a huge productivity boost for traders who want to validate ideas faster.

Tips for Effective Prompting

To make the most out of Pine Script AI for backtesting:

-

Include entry/exit conditions clearly.

-

Define stop-loss and take-profit levels.

-

Mention whether you want a strategy or an indicator.

-

Ask for inputs if you plan to optimize parameters.

Example Prompt: “Backtest a strategy where RSI crosses below 30 for entry and exits when it goes above 70. Include stop loss of 3%, TP of 6%, and inputs for RSI length.”

Conclusion

Automated backtesting is one of the most powerful use cases for Pine Script AI. It turns your strategy concepts into backtest-ready code instantly—saving you time, effort, and improving your ability to iterate faster.

🚀 Ready to backtest your next trading idea?

Visit PineScriptsAI.com and try it out for free.